Pre-Approval

Requirements

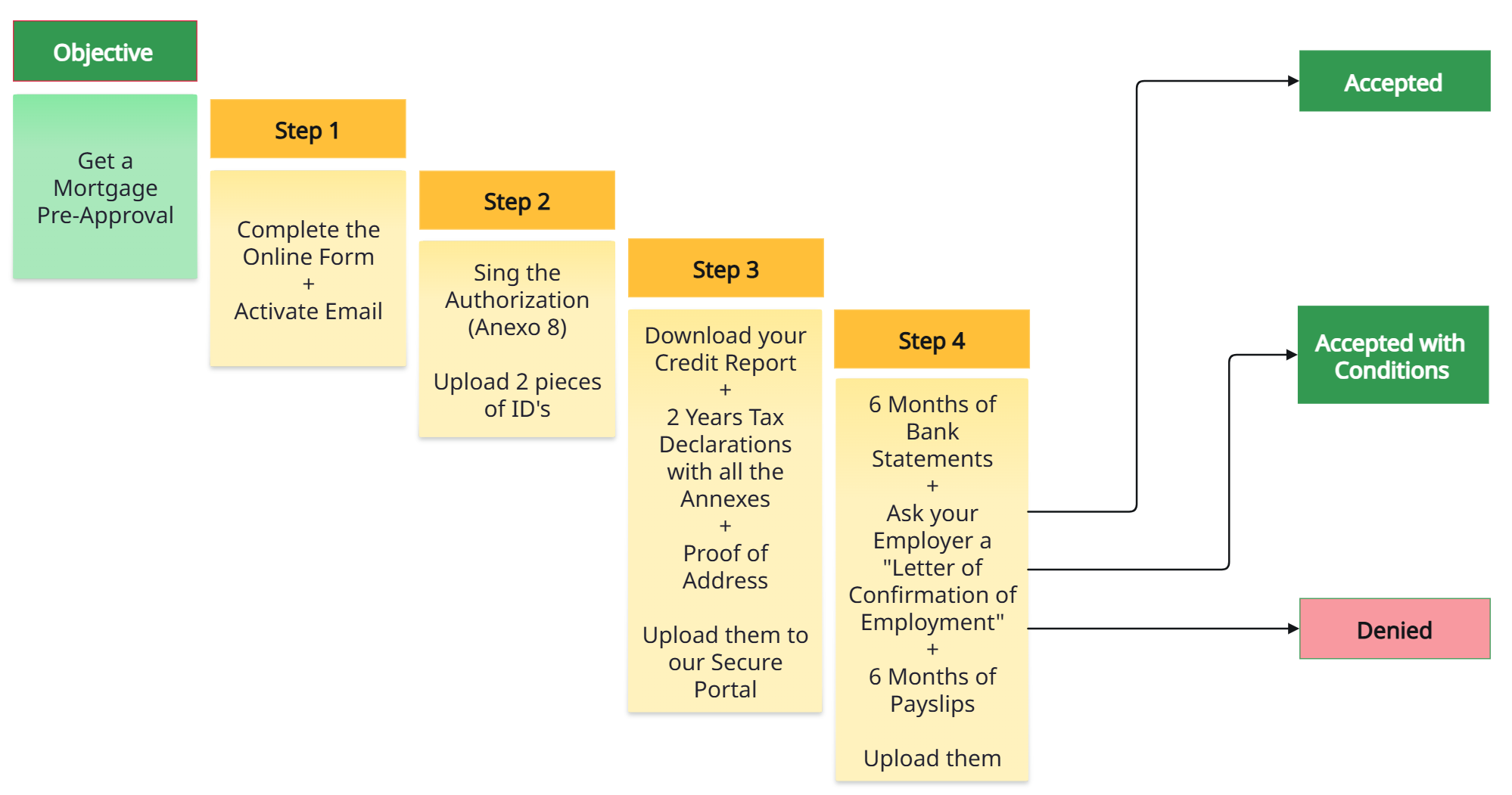

4 Steps "Pre-Approval Process"

Step 1

Book a Appointment & Complete the Online Form

Due to our High Volume demand, we didn't have choice but to charge

a 499$ USD fee for consulting.

(fully refundable at the funding of your financing at the Notary).

You'll find the answer to all your questions in the FAQ section below

Speak to you soon

Step 2

Sign the Authorization for us

to find you the best offer

We have an authorization form for you to sign.

It's called the "Anexo 8" and it's in spanish.

Don't worry, we got you cover with a traduction.

We need 2 Pieces of Valid ID's

with Picture

Passport

Drivers License

INE

Mexican Permanent Residency Card

Mexican Temporary Residency Card

*No need Mexican Residency to apply

Step 3

Credit Reports

Go online and Download your Credit Report with Fico Score

We need both of them (Equifax & Transunion)

2 Years of Tax Declarations

2023

T4 for all jobs (if more than 1)*

General T1 (Complete PDF)

Notice of Assessment

T3 and / or T5 if Applies

2022

T4 for all jobs (if more than 1)*

General T1 (Complete PDF)

Notice of Assessment

T3 and / or T5 if Applies

*In case of being a Self-Employed or Independant Worker, you don't need to provide a T4

Proof of Address

We need the most recent one

to validate your Address in Canada.

No more than 60 days.

Electric Bill

Water Bill

Landline Phone Bill

Internet Bill

Step 4

Bank Statements

6 Months for Employee

12 Months for Independant

Letter of Confirmation of Employment

Ask to your employer to write you, a “Confirmation Letter of Employment” with:

The letter needs to be Dated and Signed

Company header (Logo & Complete Address)

Job title.

Job description.

Date of Hiring (dd-mm-yyyy)

Annual Income.

Social Security Number (or Employee ID#)

6 Months of Payslips

For Self-Employed or Independant Worker,

Please write in 1 page:

Description of your Work

Services you provide

and / or

List of Products you are selling

Can I refinance my existing property in Mexico with Prisma 67 ?

Absolutely. Refinancing with Prisma 67 allows you to adjust your mortgage terms to better suit your current financial situation, access cash for other investments or personal use, or consolidate higher-interest debts.

Our refinancing options are designed to help you maximize the value and equity of your property in Mexico.

We can offer you up to 85% of the actual Property value.

Who is eligible to apply for a mortgage with Prisma 67 ?

Prisma 67 specializes in mortgage services for foreigners, particularly Canadians, interested in buying or refinancing property in Mexico. Eligibility is open to both salaried individuals and self-employed professionals, regardless of whether they own property or have an existing mortgage in their home country. We also cater to those without a Mexican credit history.

Of course, we also attend nationals clients.

What documents are required for the pre-approval process ?

To start the pre-approval process, you’ll need to provide the following:

2 pieces of Identification:

Valid passport or Driver's Licence,

Optional and not Necessary, Permanent or Temporary Mexican Residency

Proof of Income:

12 months pay stubs;

2 years tax returns, or financial statements if self-employed.

2 Years of NOA (Notice of Assessment for Canadian and American)

Letter of Employement signed by your Employer

Credit Report with Fico Score:

A credit report from your home country or a credit reference. The minimum score is 689.

Bank Statements:

Typically, the last twelve months of bank statements to verify financial stability.

Property Details:

Information on the property you wish to finance, including purchase agreements or construction plans. Additional documentation may be requested depending on the complexity of your financial profile or the type of loan.

Do I need to have a Mexican credit history to apply for a mortgage ?

No, you do not need a Mexican credit history to qualify for a mortgage with Prisma 67.

We understand that many of our clients are foreign nationals and instead consider your international credit history, financial standing, and other relevant factors to assess your eligibility.

How long does the pre-approval process take ?

Prisma 67 prides itself on an efficient pre-approval process. Once all necessary documentation has been submitted, pre-approval typically takes between 48 to 72 hours. This quick turnaround allows you to proceed with confidence in your property search or refinancing plans.

Is there a minimum down payment required to buy property in Mexico through Prisma 67 ?

The down payment requirements vary based on the type of mortgage and your financial profile.

Prisma 67 offers flexible down payment options, with some programs requiring as little as 10% down, depending on your eligibility and the property type. This makes it easier for you to enter the Mexican real estate market without significant upfront capital.

As a Foreigner, the Recommandable option is 25% or 30% cashdown

Why the interest rates seem higher in Mexico ?

Please don't get caught in the comparison with your home-country. Yes, Mexico is a developing country, but it is also the 12th economy of the world. Financing cost in Mexico will typically include not only the interest, but a lot of financial accessories (i. e. package of insurances) and value added tax (financial products are taxable, so it will also include 16% of value added tax).

When using financing in Mexico, consider that the average cost of a house in Mexico is a lot lower than in developed countries. On the other hand, the average increment of value of houses is a lot larger. For instance, the average price of a house in Mexico increased by 10.9% in 2023, while in the USA was 6.5% and -0.9% in Canada (yes, negative).

What is included in the financing cost?

Typically, a loan guaranteed by a Mortgage and granted by a Mexican Bank will include the interests (with 16% VAT included), life insurance, job insurance, disability insurance, reconstruction insurance and other protections related to protect your home and some of its contents and accessories.

Will my Mexican mortgage appear on my home-country Credit Report ?

Mexican banks do not report financing to entities like Equifax (Canada) or Experian (USA). Not even your Mortgage Pre-Approval Process will appear on your home-country Credit Report.

Can I finance the purchase of land in Mexico through Prisma 67 ?

Yes, Prisma 67 offers financing options specifically for land purchases.

Whether you’re buying land as an investment, for future development, or to build your custom home, we provide the necessary funds to secure your plot. We also offer the flexibility to transition from land purchase to construction financing when you’re ready to build.

What's is the CAT that everybody is talking about ?

The CAT (Costo Anual Total), or Total Annual Cost in English, is a financial metric used in Mexico to represent the total cost of a loan or credit product. It is expressed as a percentage and includes not only the interest rate but also other costs associated with the loan, such as fees, commissions, and insurance.

The CAT provides a more comprehensive picture of the real cost of borrowing and is designed to help consumers compare different loan offers more easily. Here's a breakdown of what the CAT typically includes:

Interest Rate: The percentage charged on the loan amount over a period, usually expressed annually.

Commissions: Any fees charged by the lender for processing the loan or providing the service.

Insurance Costs: Some loans require life or property insurance, which is also factored into the CAT.

Other Fees: This might include administrative fees, fees for late payments, or any other costs associated with the loan.

The CAT is mandatory for all financial institutions in Mexico to disclose, making it easier for consumers to understand and compare the true cost of different credit products.

What is the average interest rate on a Mortgage in Mexico ?

During 2024, the average interest rate for mortgages in Mexico was 10.3%, while the CAT (Annual Total Cost) was between 13 to 15% depending on the bank and credit conditions, remember that this “CAT” it is not only about the interest rate, it will also include insurances, value added tax and possibly bank commissions.

Do you offer financing for pre-sales?

No. Most presales will have a risk that most banks will not take as a collateral, that risk is the lack of a property title to record the mortgage. In most of the cases, developers are usually unable to transfer the ownership of the property as the project is not finished, in addition to this, they use presales to self-finance their project, so they usually require most of the cost of the property during construction. The advantage of a presale is that you could be buying something at a lower price, in change, the disadvantage is that you will not have a title of that investment until the project is finished and has completed the necessary paperwork, this could take years.

How do I start the mortgage application process with Prisma 67 ?

To begin your mortgage application, simply schedule an appointment through our automated system on our website.

During this initial consultation, we’ll discuss your needs, explain our services, and guide you on how to submit the necessary documentation via our secure client portal. Our team is available to assist you every step of the way, ensuring a smooth and stress-free application process. We will be with you from the beginning to the signature at the Notary (Notaria Publica).

What are the benefits of using Prisma 67 compared to other mortgage providers ?

Prisma 67 offers several unique benefits:

Specialization in Foreigners: We understand the specific needs and challenges faced by foreigners investing in Mexico. One of our Senior Broker, Alain Bessette, is the first and only Canadian to have his Mexican Mortgage Broker Licence in all Mexico. He worked in that industry for several years in Canada, so that gives Prisma a big advantage by understanding the foreign investors.

Quick Pre-Approval: Our efficient pre-approval process helps you move forward quickly with your property plans.

24/7 Customer Support: Our AI Assistant, Maria, provides round-the-clock support, answering your questions and guiding you through the process.

Flexible Financing Solutions: We offer customized mortgage solutions that cater to your individual circumstances, including flexible down payments and financing for a wide range of property types.

Comprehensive Support: From pre-approval to closing, we offer end-to-end support, ensuring a seamless and hassle-free experience.

Are there any additional fees associated with obtaining a mortgage through Prisma 67 ?

Yes, there are standard processing fees associated with obtaining a mortgage. These include appraisal fees and closing costs. When the property is in a "Restricted Area" for example within 50km form the ocean or the border, Foreigners need to open a "Fideicomiso" to be able to buy a property. This Fideocomiso got a fee. Usually, the bank who will finance your property works with a "fiduciario", so please, do not start any process before getting your Pre-Approval to know the conditions of your future mortgage. We do not want you to have extra charges.

Prisma 67 is committed to transparency, and all fees will be clearly outlined during the application process. There are no hidden charges, and we ensure that you are fully informed of all costs involved. The bank pays us, not you.

How does Prisma 67 assist with the property purchasing process in Mexico ?

Prisma 67 provides comprehensive support throughout the property purchasing process:

Pre-Approval: We help you determine your budget and get pre-approved for a mortgage.

Property Search: We collaborate with reputable real estate agents and developers to help you find the perfect property.

Financing: We structure a mortgage that fits your financial situation and guide you through the entire financing process.

Closing: We work with legal professionals and notaries to ensure all documents are in order and the transaction is completed smoothly.

Post-Purchase Support: After your purchase, we offer ongoing support, including refinancing options and advice on property management

What happens if I need to sell my property before the mortgage is fully paid ?

If you decide to sell your property before your mortgage is fully paid off, Prisma 67 will assist you in managing the sale and settling the outstanding mortgage balance. We offer options such as refinancing or loan switching to help you manage your financial commitments effectively. Our team will guide you through the process, ensuring that all legal and financial obligations are met.

It's possible to have some penalties for breaking your contract, but normally, after 48 months, you can liquidate your mortgage without any penalties.

We are a Financial Professional team fully certified and regulated by the “Asociación de Brokers Hipotecarios de México” At Prisma 67, your data and information are always safe.

Visit us on Social Medias

Email:

+1-450-485-6767

Office:

Calle 13 Sur, C. Diag. 70 Sur, Ejidal,

Playa del Carmen, Solidaridad,

Quintana Roo, Mexico

77712