FINALLY

Mortgage Financing

in Mexico,

For Foreigners

Our speciality

Mortgage Program

for

Foreigners

Purpose of the Mortgage

Discover the Right Mortgage for Your Needs

At Prisma 67, we understand that every client's financial journey is unique.

Whether you're looking to purchase your first home, refinance an existing property,

Below, explore the various purposes for which our mortgages can be utilized:

Refinancing a Property

The Benefits

Access to Cash: Unlock equity in your home for renovations, investments, or other financial needs. It's like selling your property to yourself.

Refund your 401K: Before, you needed to pay cash to buy property in Mexico. The only strategies was to Refinance your home-country property or Cash-out your 401K.

NOW, you can re-balance your financial situation

Improved Private Loan Terms: Adjust terms to better fit your financial situation, whether it's a shorter loan term or more flexible payments.

Send back money to your Home-Country: The currency rate is the now in your favor.

Purchasing a Property

The Benefits

Get Financed up to 75%.

By reducing your down payment to 25%, you can buy 2 properties instead of just one.

*In some case, the banks offers up to 90%

Build Equity: Owning a property allows you to build equity over time, creating long-term financial stability.

Fixed Monthly Payments: With a fixed-rate mortgage, your monthly payments remain predictable, making budgeting easier.

Tax Benefits: Mortgage interest payments may be tax-deductible, reducing your overall tax burden.

Appreciation Potential: Real estate typically appreciates in value over time, increasing your net worth.

Note that in the last 5 years, the value of the properties habve double

Financing Renovations

Put your property at work and

use the bank's money to increase your Property's value

The Benefits

Custom Home Design: Build your dream home from the ground up with the freedom to design every detail.

Staged Payments: Pay for construction in phases, aligning payments with project milestones and managing cash flow.

Increase Property Value: A well-constructed home can significantly increase the overall value of your land.

Energy Efficiency: Incorporate modern, energy-efficient features during construction, reducing future utility costs.

Buying a Presale

The Benefits

Lower Purchase Price: Presale properties often come at a lower cost than completed homes, offering potential savings up to 40%.

Customization Options: Be among the first to select finishes, layouts, and features tailored to your preferences.

Future Value Increase: Purchase at today's prices and benefit from property value appreciation by the time it's completed.

Flexible Payment Plans: Presales often offer staged payments, allowing you to manage your finances better over the construction period.

Please note that is the most risky transaction you can make in a foreign country. Yes, the plus-value is the most interesting, but so many things can go wrong during the process:

Anormal delays;

Change of city administration and new Environmental rules;

(Construction Licence and Completion certificate);

Problems to deliver deeds and/or Titles.

*This is for Expert only.

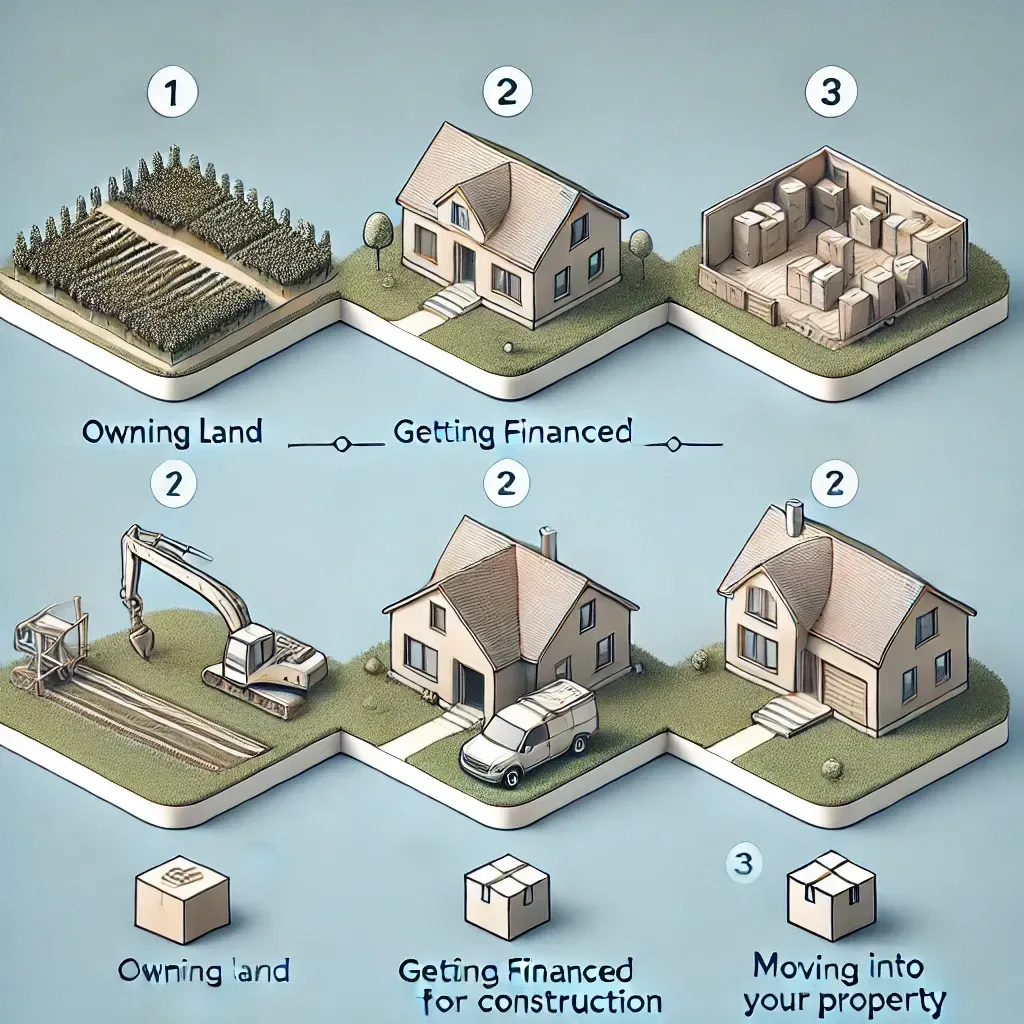

Buying Land

The Benefits

Investment Potential: Land often appreciates over time, offering a solid investment opportunity.

Flexibility: Own land with the freedom to build, develop, or hold as a long-term asset.

Lower Initial Cost: Land typically requires a lower upfront investment compared to developed properties.

Custom Development: Tailor your future property exactly as you envision, with complete control over construction.

Financing Construction Over Land

The Benefits

Custom Home Design: Build your dream home from the ground up with the freedom to design every detail.

Staged Payments: Pay for construction in phases, aligning payments with project milestones and managing cash flow.

Increase Property Value: A well-constructed home can significantly increase the overall value of your land.

Energy Efficiency: Incorporate modern, energy-efficient features during construction, reducing future utility costs. Solar panels are a must.

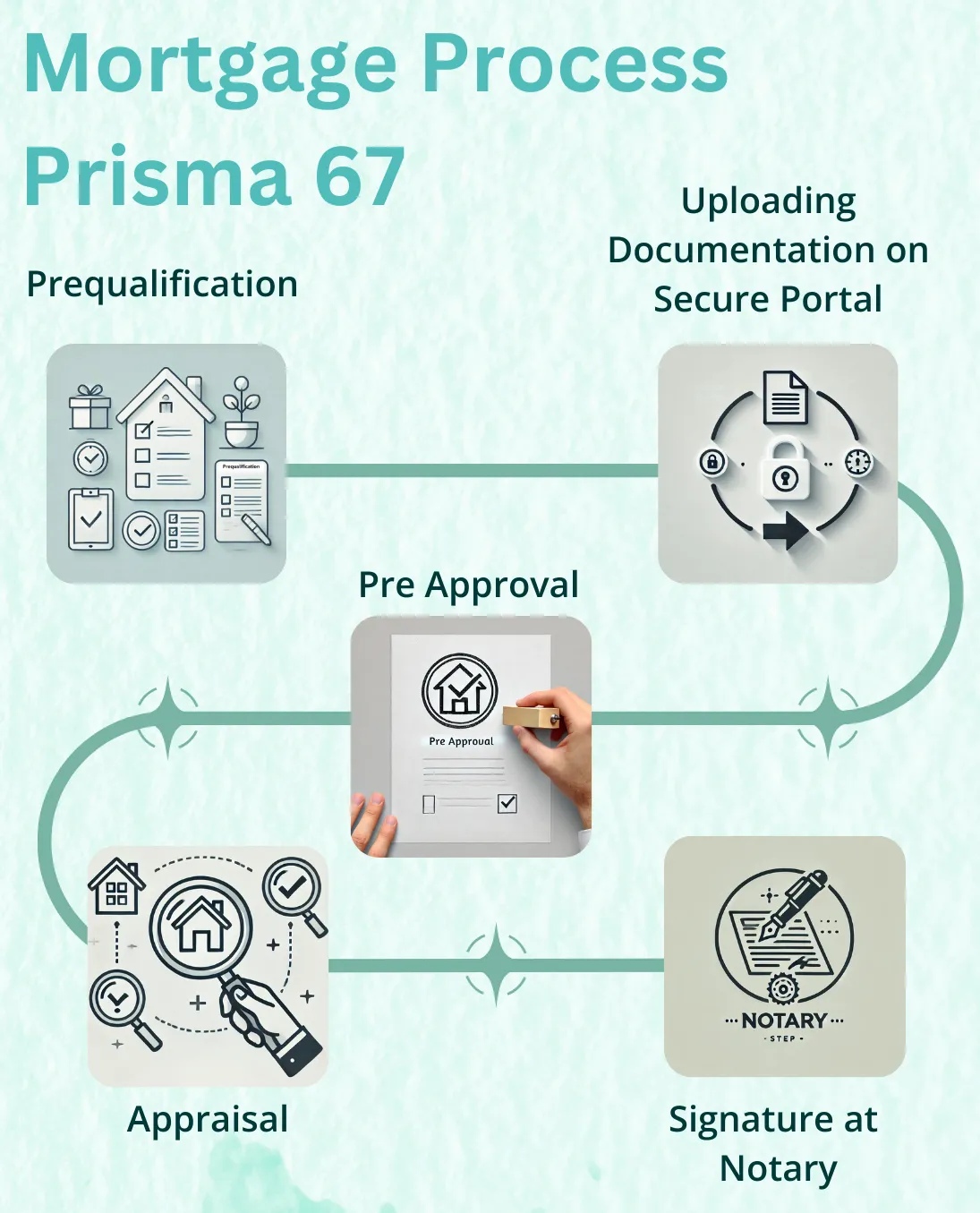

Here’s a concise outline

for the mortgage process

Prequalification:

The initial step where you discuss your financial situation with a lender to determine your eligibility for a mortgage.Upload Documentation on our Secure Portal:

After prequalification, securely upload all required documents (like income statements, credit reports, etc.) to the lender’s secure portal for review.Pre-Approval:

Based on the documents submitted, you receive a pre-approval letter, which states the loan amount you qualify for, giving you a clear budget for property shopping.Appraisal:

Once you’ve found a property, an appraisal is conducted to ensure its market value aligns with the loan amount. At the same time, all the documentation of the property is analysed by the bank to make sure that everything is in order.Notary:

The final step, where you sign all necessary documents in the presence of a notary to finalize the mortgage and ownership transfer.Prisma 67 will go with you for the signature.

We are a Financial Professional team fully certified and regulated by the “Asociación de Brokers Hipotecarios de México” At Prisma 67, your data and information are always safe.

Visit us on Social Medias

Email:

+1-450-485-6767

Office:

Calle 13 Sur, C. Diag. 70 Sur, Ejidal,

Playa del Carmen, Solidaridad,

Quintana Roo, Mexico

77712